The Circle of Life (in the Canadian Oil Patch)

- Neil Watson

- Oct 28, 2019

- 3 min read

(Source: https://disney.fandom.com/wiki/Circle_of_Life)

This article is the first in a three part series on the roots of the employment crisis in the western Canadian oil patch, a possible path forward and, to wrap up, key workflow steps that might help.

Let me begin by stating that I unequivocally support the building of pipelines as the most economically efficient and environmentally conscious way to get oil and gas to market. Even if we have to resort to some innovative ways around jurisdictional roadblocks. If you need convincing on those points, I recommend you check out Chris Slubicki's YouTube video on the subject.

But I am not using this space to bang that drum, because pipelines alone won't solve the employment crisis. Realizing fair prices for our product will definitely help with company profits. Maybe even enough so that companies will be able to do some hiring so that the people currently working only have to do the work of 2 people rather than 3. But the pressure for companies to return free cash flow to their investors will continue unabated. And prices alone are not the reason for the unemployment.

The technological advancements and nature of the plays currently being funded (resource plays such as the Montney and Duvernay, or SAGD) simply require less staff. Ten years ago it took 30,000 people to produce 1 million barrels of oil. The same production level is accomplished by 12,000 people today (personal communication, Marty Hewitt via Financial Post). Neither pipelines nor prices are going to compensate for a 60% drop in staffing requirements.

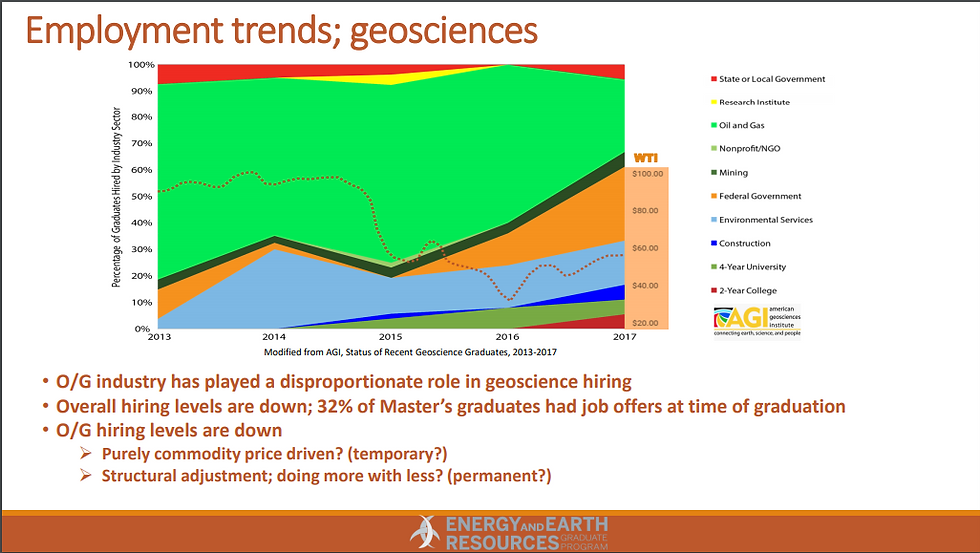

And this trend is not confined to Canada. The trend to lower staffing levels per MM boe is seen even in the (until recently) white hot Permian Basin,

Cuchla, 2019

The Canadian industry used to consist of a spectrum of companies ranging from the world's largest to intermediates to Juniors to startups. The majors and intermediates were the big kids on the block with large staffing levels. The start-ups (an engineer, a geologist and a landman walked into a bar... and started an oil company) were numerous. They would start from nothing and build up to a size that made them attractive to an intermediate (the "Exit Strategy"). Or continue to grow until they were a Junior on their way to becoming an Intermediate. But the Exit Strategy was always there. They could sell off and start another company. And the cycle continued. And thus a lot of talented people were employed.

But since the advent of resource plays, it is the rarest of startups that can attract capital.

There is no magic bullet in the form of a pipeline that will bring the small company jobs back.

But what will bring the jobs back is successful Startup and Junior sectors. What will bring the jobs back is plays that the Startup/Juniors can develop and return free cash flow to their investors.What will bring them back is innovative thinking.

Over the course of my career, I have been through more downturns than I would have thought possible. The reasons for the downturns have ranged from inept government policy, geopolitical standoffs to protect OPEC market share to "gas bubbles" related to pipeline constraints (this isn't our first megaproject rodeo). The one constant has been that the Canadian patch has always been able to find innovative ways to move forward.

Is there such a path forward? Perhaps. You will have to read Part 2: "You're Gonna Need A Bigger Boat" to find out.

References

Cuchla, R., 2019. Preparing Graduates for an Evolving Energy Future. University of Texas at AUstin.

Comments